owe state taxes because of unemployment

So if you didnt withhold the appropriate amount of taxes when receiving unemployment benefits in 2021 youll owe the IRS money for that especially if you withheld. Yes you can owe taxes on unemployment payments because unemployment is taxable income.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

You received more than 10200 in unemployment benefits and so you owe income taxes on that extra amount.

. Because of this CNBC reported that millions of people didnt owe any tax on their 2020 benefits or owed a lesser amount. You need to do step 1 only once step 2 whenever you hire a. Check all of the data you entered and.

If your state of residence collects income taxes you may have to pay taxes on your benefits to both state and. Unemployment benefits are taxable income and if you did not withhold money from each check then youll owe about 10 percent when you file. New York which has the second highest unemployment rate in the country is one of just 11 states that is fully taxing unemployment benefits according to HR Block.

Depending on the state you live in you may owe state taxes from unemployment benefits as well. Any money that you receive is subject to federal or state tax or both. Some states dont tax unemployment while others provide the option to.

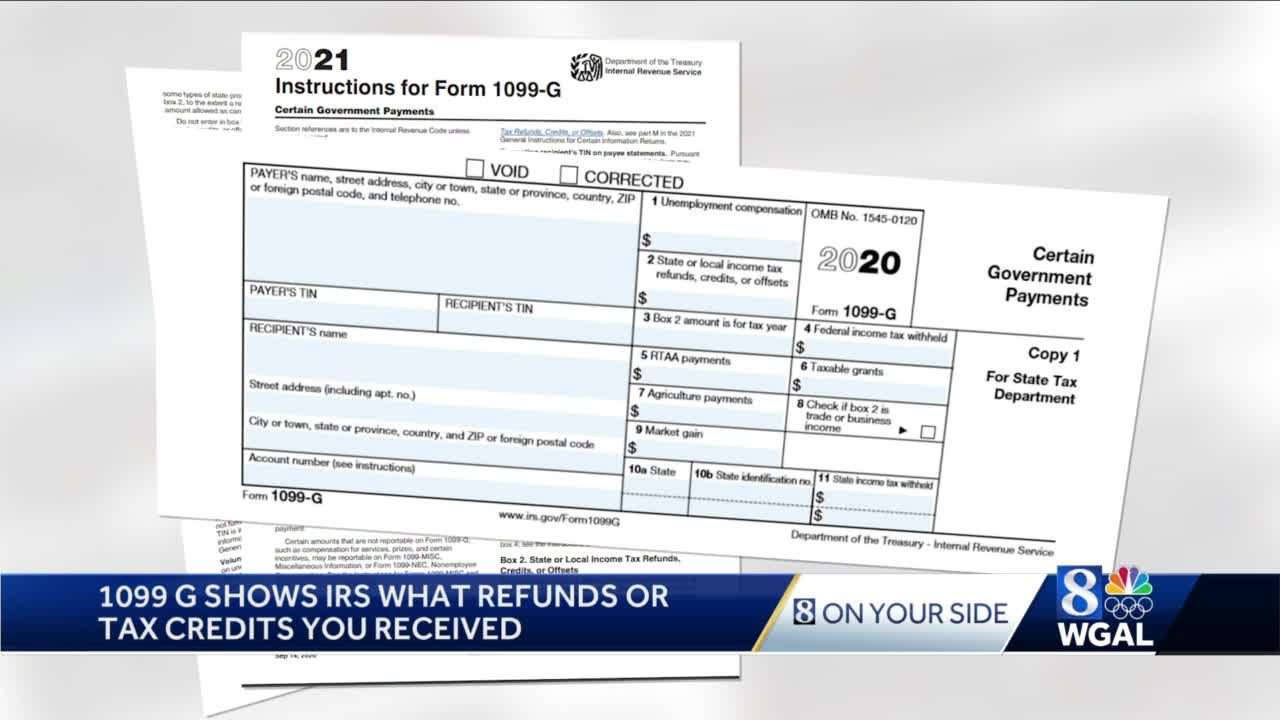

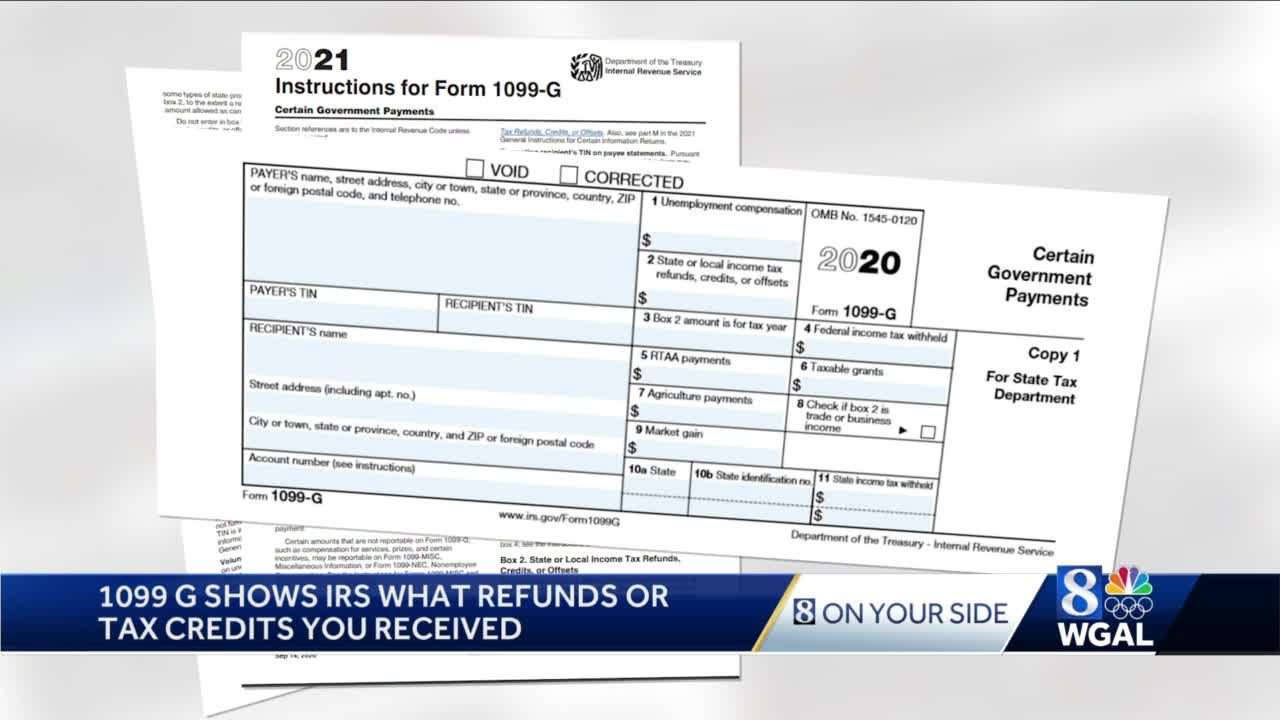

To stay on top of this issue you should adhere to your Form 1099-G which you will receive from the IRS in the mail that will tell you how much you must report in. Department of Revenue spokesman Mike Gowrylow said the businesses owe a total of 183 million in back taxes which is higher than the states average back-tax amount of. The tax season shocker for many jobless people will be that their tax refund could be far smaller or they owe taxes.

To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment. It depends on what state you live in. If you received unemployment income in 2021 you.

It depends on what state you live in. 45201 Research Pl Ste 100. You can do the same thing with unemployment income.

You had other income separate from unemployment benefits and. Follow reporting requirements and pay premiums according to the Washington State paid family and medical leave program. Do you have to pay state taxes on unemployment.

Some states may allow you to withhold 5 for state taxes. State unemployment benefits will be considered taxable. For the 2020 tax year however the American Rescue Plan Act allows single taxpayers with modified adjusted gross income of less than 150000 to exclude up to 10200.

You may also be shocked to learn that DCS will attempt to garnish your unemployment benefits even if this makes it impossible for you to pay your rent buy food and meet other basic. Youll probably also owe state income taxes on the unemployment benefits unless you live in one of the nine states that dont have a state income tax Washington is one of. The usual reason for owing state tax is that you did not have enough withheld from your paychecks---or perhaps from your unemployment.

Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin. Yes you can owe taxes on unemployment payments because unemployment is taxable income. Certain unemployment compensation debts owed to a state generally these are debts for 1 compensation paid due to fraud or 2 contributions owing to a state fund that.

In every other state unemployment benefits are treated as regular income. If you live in one of the seven states that dont have state income tax at all you shouldnt see any indication that you owe the state income tax. You may have to pay estimated quarterly payments or pay taxes when you file your annual tax return if you dont.

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Fillable Form 940 2019 Irs Forms Fillable Forms Form

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2 Part Ncr Invoices 100 Sets 81 2 X 11 Black And Etsy Invoice Design Invoicing Ncr

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

The Case For Forgiving Taxes On Pandemic Unemployment Aid

How Being Laid Off Furloughed Or Fired Will Affect Your Taxes Glamour

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Tax Preparation Tax Prep Checklist

1099 G Tax Form Why It S Important

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

How Covid Might Impact Your Taxes This Year Rutgers University

Tax Refunds On Unemployment Benefits Still Delayed For Thousands